The Biden-Harris Administration released its first set of draft rules that propose to provide student debt relief for tens of millions of borrowers across the country.

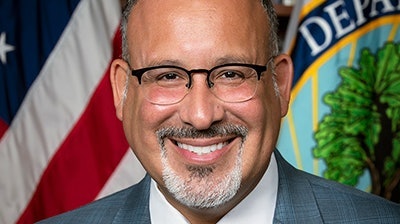

"Student loan forgiveness isn't only about relief for today's borrowers,” said U.S. Secretary of Education Dr. Miguel A. Cardona. “It's about social mobility, economic prosperity, and creating America that lives up to its highest ideals."

Dr. Miguel Cardona

Dr. Miguel Cardona

The U.S. Department of Education will consider comments received and aims to finalize the rules in time to start delivering relief in the fall, including for borrowers who have been subject to runaway interest.

The department plans to publish a draft of a second rule focused on providing relief for borrowers experiencing hardship in the coming months. The draft includes nine rules that permit separate and distinct types of waivers using the Secretary of Education’s authority under the Higher Education Act — eight of them are applicable to loans held by the department, while a ninth addresses commercially held loans in the Federal Family Education Loan (FFEL) Program.

For canceling runaway interest, the department proposes permitting automatic relief of up to $20,000 of the amount by which a borrower’s loans currently exceed what they owed upon starting repayment. A second, separate rule would permit the secretary to forgive the full amount by which a borrower saw their balance grow after entering repayment if the borrower is enrolled in any Income-Driven Repayment Plan and meets certain income requirements.

For eliminating student debt for borrowers who entered repayment at least 20 years ago, the proposal would permit student debt forgiveness for borrowers with only undergraduate debt if they first entered repayment at least 20 years ago (on or before July 1, 2005). Borrowers with graduate school debt would qualify if they first entered repayment 25 or more years ago (on or before July 1, 2000).